Forex vs. Stocks: Choosing Your Financial Battlefield

Forex vs. stocks

In the realm of financial markets, two titans stand tall – forex (foreign exchange) and stocks (equity). These markets are where traders and investors engage in the pursuit of profits, but they do so in significantly different arenas. In this article, we’ll explore the differences, similarities, and considerations when choosing between Forex and stocks.

Understanding Forex

“Forex, the largest and most liquid financial market, is where currencies are traded. It’s a global marketplace that never sleeps.”

Forex, also known as the foreign exchange market, is where currency pairs are traded. It’s a decentralized market that operates 24 hours a day, five days a week, encompassing major financial centers worldwide. The primary goal of forex trading is to profit from the exchange rate fluctuations between different currencies.

Understanding Stocks

“Stocks represent ownership in a company. When you buy a stock, you own a piece of that company and have a say in its decision-making.”

Stock markets are where shares of public companies are bought and sold. Owning a stock means owning a piece of the company and potentially having a say in its decisions. Stock markets operate on specific trading hours based on their respective regions.

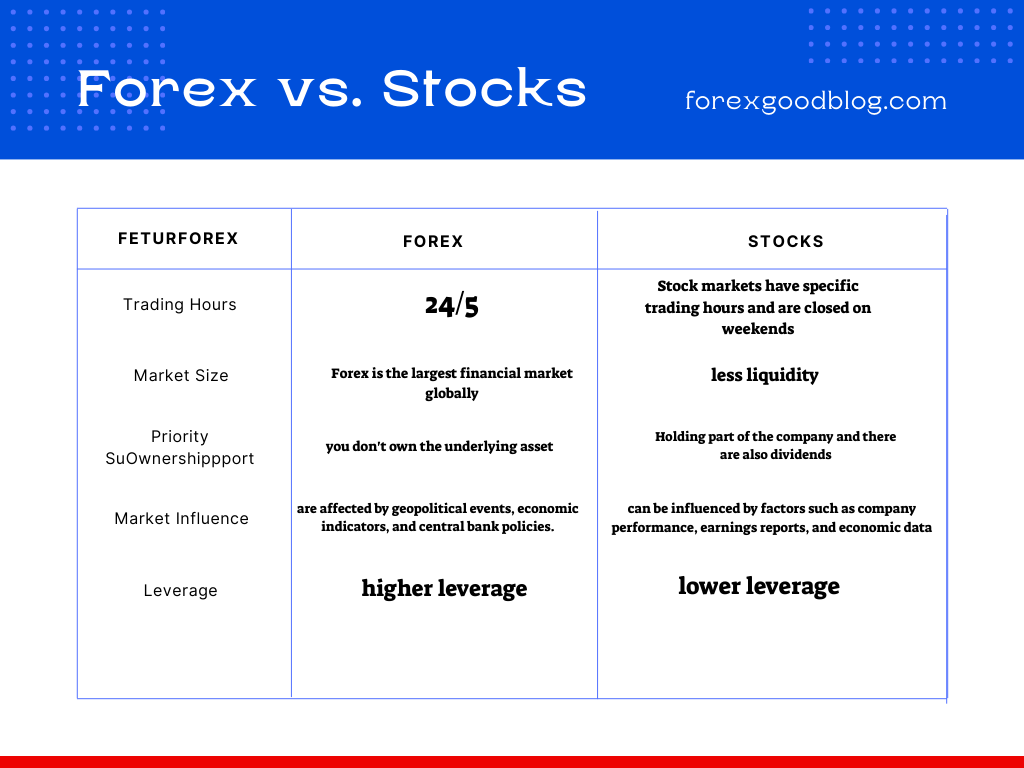

Differences Between Forex and Stocks

1. Trading Hours

Forex markets operate 24/5, allowing for continuous trading throughout the week. Stock markets have specific trading hours and are closed on weekends.

2. Market Size

Forex is the largest financial market globally, with a daily trading volume that dwarfs that of the stock market. This high liquidity in forex means smaller spreads and lower trading costs.

3. Ownership

Forex trading involves currency pairs, where you speculate on price changes, but you don’t own the underlying asset. Stock trading, on the other hand, means owning a piece of a company and possibly receiving dividends.

4. Market Influence

Stock markets can be influenced by factors such as company performance, earnings reports, and economic data. Forex markets are affected by geopolitical events, economic indicators, and central bank policies.

5. Leverage

Forex trading often offers higher leverage, allowing traders to control larger positions with a relatively small amount of capital. Stock trading typically offers lower leverage.

Similarities Between Forex and Stocks

1. Technical Analysis

Both markets rely on technical analysis, which involves studying price charts and patterns to make trading decisions.

2. Risk Management

Risk management is essential in both markets. Setting stop-loss orders and position sizing are crucial strategies.

3. Profit Potential

Both markets offer profit opportunities. Successful traders in either market can achieve their financial goals.

Choosing Your Battlefield

“The choice between forex and stocks depends on your goals, risk tolerance, and trading style. Some traders prefer the fast-paced, 24-hour action of forex, while others opt for the long-term investments associated with stocks.”

Choose Forex if:

- You prefer 24-hour trading.

- You’re comfortable with high liquidity.

- You want to speculate on currency fluctuations.

Choose Stocks if:

- You’re interested in owning a piece of companies.

- You prefer trading during specific hours.

- You’re looking for long-term investments.

Forex vs. stocks

Conclusion

Forex vs. stocks is not a battle of one being better than the other; it’s about selecting the market that aligns with your goals and trading style. Both markets have unique advantages and characteristics, making them valuable options for traders and investors.

Note: For more educational resources and trading tips, visit our website at ForexGoodBlog.

In the end, the choice between forex and stocks is a personal one. Some traders dabble in both, while others commit to one. Regardless of your choice, the key to success lies in education, practice, and a well-thought-out trading strategy. Happy trading!

For an article on hammer strategy click here

To see a forex broker click here