Setting Up Charts and Timeframes: Your Roadmap to Informed Forex Trading

When it comes to forex trading, one of the key elements in your toolbox is setting up charts and choosing the right timeframes. In this guide, we’ll explore the art of configuring your charts and selecting timeframes, essential skills that will empower you to make well-informed trading decisions.

Setting Up Charts and Timeframes

Why Setting Up Charts and Timeframes Matters

Before we dive into the practical aspects, it’s essential to understand why setting up charts and timeframes is a critical part of your trading journey:

“Charts and timeframes are the lenses through which traders interpret the markets. They are the foundation of technical analysis and are crucial for identifying trading opportunities.” – ForexGoodBlog

Setting Up Charts and Timeframes

Setting Up Charts

Setting up your charts is like preparing your canvas before painting a masterpiece. Here’s how you can do it:

1. Selecting Currency Pairs

Begin by choosing the currency pair you want to analyze. This can be done through the Market Watch window in MetaTrader 4 (MT4). Simply right-click, select “Symbols,” and choose the pair you’re interested in.

2. Chart Types

Next, select your preferred chart type. The most commonly used charts in forex trading are candlestick charts. These provide a wealth of information in a single view.

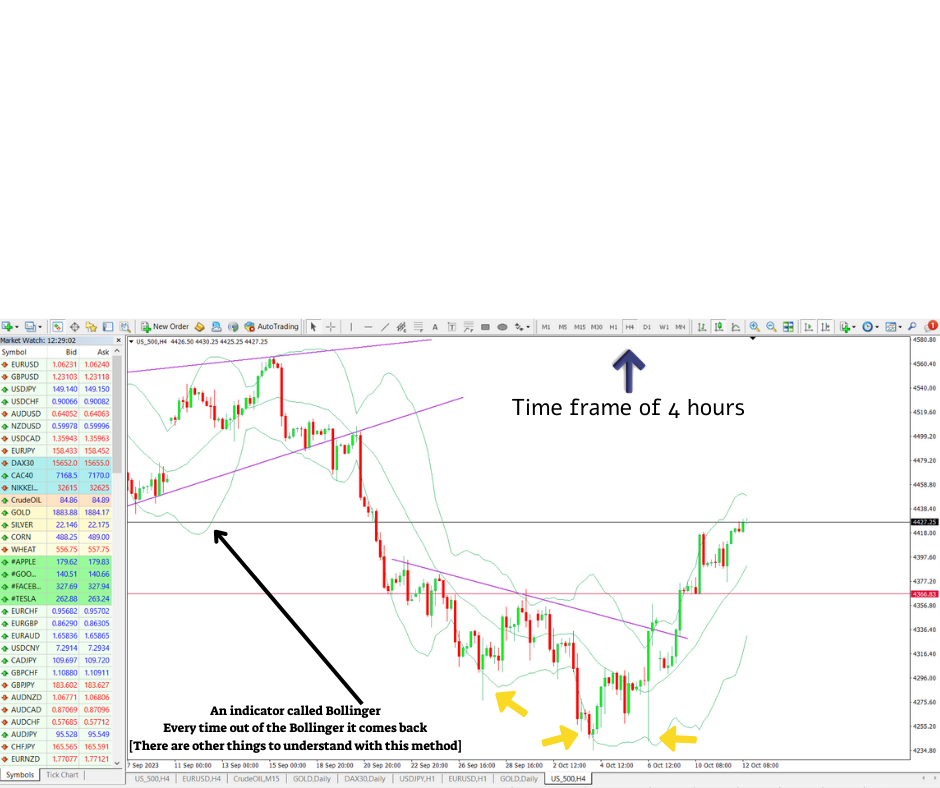

3. Adding Indicators

Indicators are powerful tools for technical analysis. You can add them to your chart to gain insights into price movements. Common indicators include Moving Averages, Relative Strength Index (RSI), and MACD.

Pro Tip: For an in-depth exploration of technical indicators, visit our article on Mastering Technical Indicators.

4. Customizing Your Chart

MT4 allows you to customize your chart. You can change the color scheme, background, and gridlines to suit your preferences. This makes it easier to interpret the data.

Selecting Timeframes

Timeframes are the windows of opportunity in forex trading. Here’s how to choose the right one:

1. Understanding Timeframes

Timeframes represent the time intervals for each candlestick on your chart. They can range from as short as one minute to as long as one month. Traders use different timeframes to analyze the market from different perspectives.

2. The Most Common Timeframes

- M1 (1 Minute): Provides a very short-term view of price movements.

- M5 (5 Minutes): Offers a slightly longer perspective.

- H1 (1 Hour): Popular for day trading.

- D1 (1 Day): Useful for swing trading.

- W1 (1 Week) and MN (1 Month): Used for long-term analysis.

Choosing the Right Timeframe

The choice of timeframe depends on your trading style. Day traders often focus on short timeframes like M1, M5, and H1, while swing traders may prefer H4 or D1.

Pro Tip: To learn more about matching your trading style with the right timeframe, check out our article on Choosing the Best Timeframe for Your Trading Style.

Conclusion

Setting up charts and selecting timeframes are fundamental skills for any forex trader. They lay the groundwork for your trading strategy and provide the lenses through which you view the markets.

Note: For more educational resources and trading tips, visit our website at ForexGoodBlog.

Armed with the ability to configure charts and choose the right timeframes, you’re well on your way to becoming a skilled forex trader. Happy trading!