Using Built-in Chart Tools: Mastering Forex Analysis with Precision

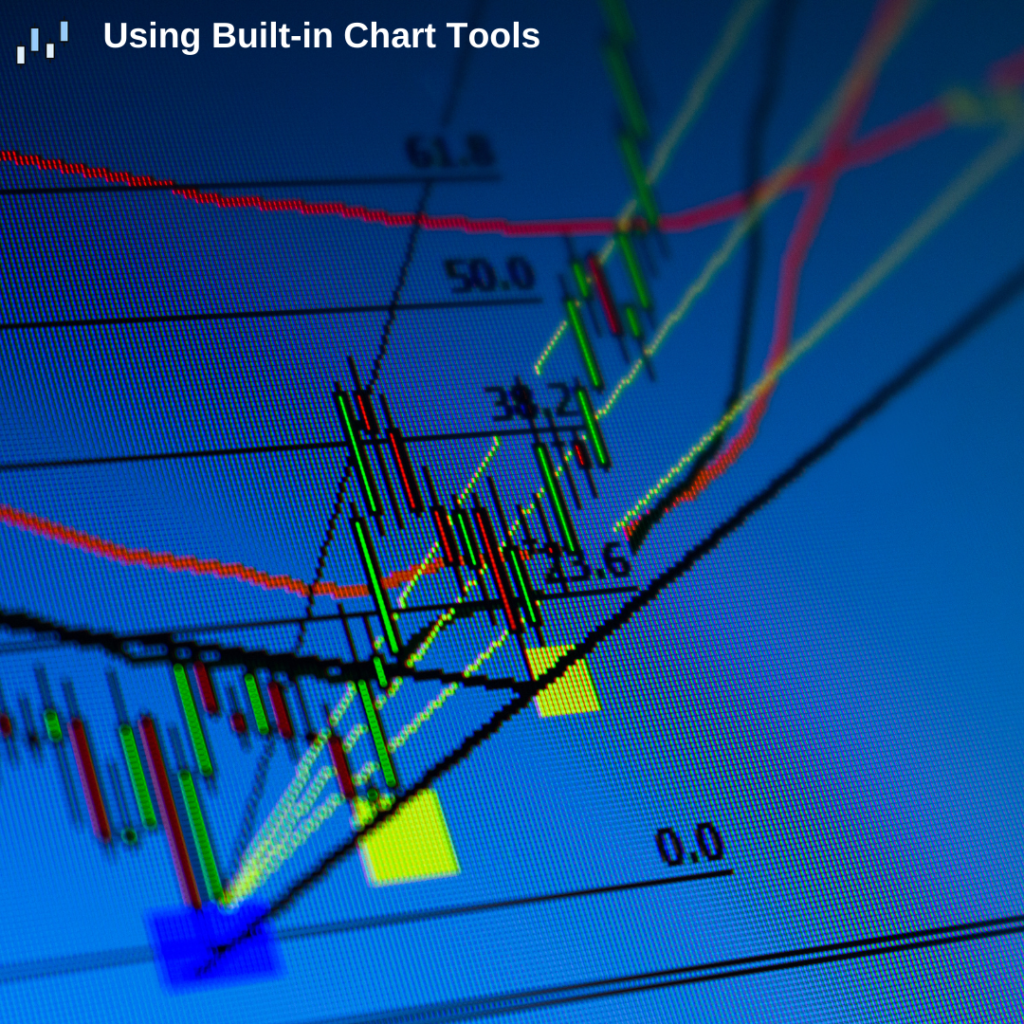

Using Built-in Chart Tools

When it comes to navigating the intricate world of forex trading, precision is key. In this quest for precision, your trading platform is your trusty companion, and within it are powerful built-in chart tools that can help you make informed decisions. In this guide, we’ll unveil the potential of these tools, showing you how to harness their capabilities and elevate your trading game.

Chart Tools: The Art of Precision

Before we dive into the details, let’s understand the significance of using built-in chart tools:

“Chart tools are like the artist’s brushes and palette. They help traders paint a clear and insightful picture of market trends, patterns, and potential trade opportunities.” – ForexGoodBlog

Line Studies: Drawing Insights with Precision

Line studies are a fundamental part of technical analysis. They enable traders to draw and interpret essential lines on their charts. Here are some key line studies:

1. Trendlines

Trendlines are used to identify and confirm trends. They are drawn by connecting two or more significant price points, creating a line that highlights the trend’s direction.

2. Support and Resistance Lines

These lines indicate price levels where a currency pair may find support (price doesn’t go lower) or resistance (price doesn’t go higher). Drawing these lines can help traders identify potential entry and exit points.

3. Fibonacci Retracement

Fibonacci retracement levels are drawn to identify potential levels of support or resistance based on Fibonacci ratios. This tool is particularly useful for predicting price reversals.

Pro Tip: For a comprehensive guide on Fibonacci retracement, visit our article on Mastering Fibonacci Retracement in Forex.

Geometric Shapes: Crafting Patterns with Precision

Geometric shapes help traders identify patterns in the market, which can be crucial for decision-making. Some essential geometric shapes include:

1. Channels

Channel patterns consist of two parallel trendlines, with prices moving between them. Channels can be ascending (bullish), descending (bearish), or horizontal (sideways).

2. Flags and Pennants

Flags and pennants are short-term continuation patterns that indicate a brief consolidation before the prevailing trend resumes.

3. Head and Shoulders

The head and shoulders pattern is a reversal pattern that can signal a change in trend direction. It consists of three peaks, with the middle peak being the highest.

Pro Tip: To delve deeper into chart patterns and how to trade them, explore our article on Mastering Forex Chart Patterns.

Using Built-in Chart Tools

Specialized Tools: Refining Analysis with Precision

Besides basic line studies and geometric shapes, many trading platforms offer specialized tools for advanced analysis. These tools include:

- Gann Fans: Used for identifying potential support and resistance levels.

- Elliott Wave: Applied to predict future price movements based on wave patterns.

- Andrew’s Pitchfork: Used for drawing equidistant channels and identifying price targets.

Conclusion

Using built-in chart tools is like wielding a master’s paintbrush; it empowers you to craft a clear and precise picture of the forex market. These tools are essential for technical analysis and can guide your trading decisions with accuracy.

Note: For more educational resources and trading tips, visit our website at ForexGoodBlog.

With the ability to leverage chart tools effectively, you’re on the path to trading with precision and confidence. Happy trading!